GOLDEN DRAGON MINING LIMITED - INITIAL PUBLIC OFFER (IPO)

Golden Dragon Mining Limited (Proposed ASX code: GDR)

Initial Public Offer (Offer)

Initial Public Offer (Offer)

Sanlam Private Wealth, the Lead Manager, has invited Marketech Focus clients to participate in the Initial Public Offer (Offer) for Dragon Mining Limited (Company or GDR).

GDR is a junior Australian mining exploration company. The Company owns four exploration projects and two mining leases with a focus on gold. All projects are located in Western Australia and provide diversification including exposure to antimony, lithium, nickel and other critical metals. The Company intends to undertake exploration activities on these projects and to explore further opportunities to add to its impressive portfolio with the view to building value for shareholders.

The Company invites investors to apply for 25,000,000 Offer Shares at an issue price of $0.20 per Offer Share to raise $5,000,000 before costs.

Bids for the Offer should be lodged by 3.00pm (AEST) Thursday 18 September 2025. The Lead Manager reserves the right to close the offer early subject to demand.

Please review the Prospectus before placing any bid.

Summary

The Company is backed by a strong team with experience in the resources sector and an ideal combination of technical expertise and international capital markets experience. GDR is targeting an IPO listing in early September.

The Company’s key projects are:

Cue Project

The Cue project is a substantial landholding in Western Australia which comprises three tenements covering a total area of over 600km2. The project is approximately 60km northwest of the town of Cue and 670km NNE of Perth. Located in a Tier 1 mining jurisdiction within a world class gold province and region endowed with >35Moz of gold, this is the Company’s flagship project. The project is only 16km along strike from the world class Big Bell gold mine and Cuddingwarra gold mine operated by Westgold (ASX:WGX).

Behring Bore/Coodardy

• High grade Resource at Coodardy (non JORC), 11,000oz @ 3.0g/t Au within M20/455 1.

• Curtis Find presents a compelling high-grade discovery

• Behring Bore Main is defined by +1g/t over an area of approximately 900m x 500m.

Stella Range Project

The Stella Range project is located in the Eastern Goldfields region of Western Australia in an emerging new gold province. The project covers an area of 131.49 km2 and is approximately 750km to the northeast of Perth, 222km to the northeast of Kalgoorlie and 92km to the southeast of Laverton. Gold Road (ASX:GOR) recently acquired a large land holding south of the project which supports the project as a new camp scale gold province.

Highlights

- Strategic assets in Western Australia’s premier gold districts

- Positioned for scale with multiple advanced-stage targets

- Expansive contiguous tenure along strike from major producers

- Multiple walk-up targets with near-term discovery and resource potentialDrill ready pipeline of targets

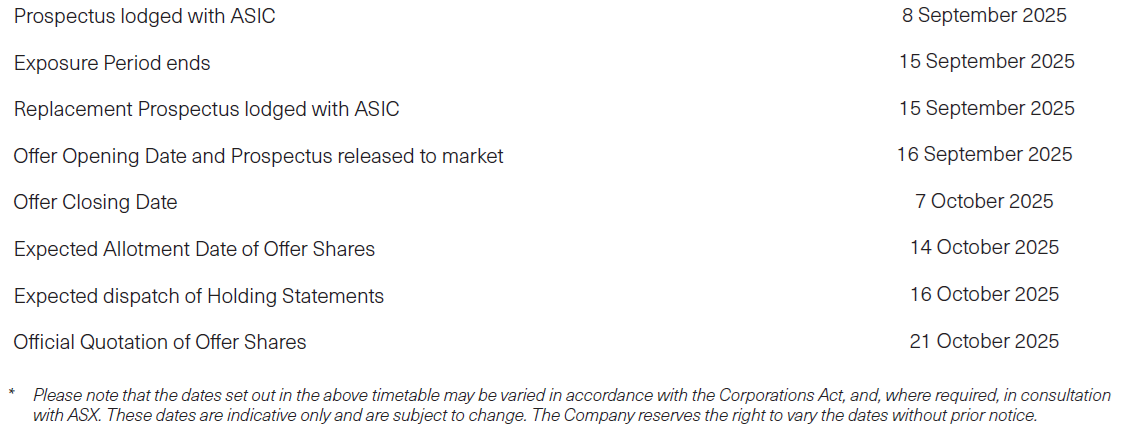

Indicative Timetable

Board and Management

Francesco Cannavo – Non-Executive Director

- Experienced public company director and entrepreneur with significant business, capital raising and investment experience across the mining and natural resources sector.

- Founder and current Non-Executive Director of ASX-listed junior mining exploration companies, Lightning Minerals Ltd (ASX:L1M), Western Mines Group Ltd (ASX:WMG) and Golden Mile Resources Ltd (ASX:G88).

Rhoderick Grivas – Non-Executive Chairperson

- Experienced geologist with over 25 years’ experience in all facets of the mineral industry from board representation, executive management, government partnerships, marketing, financing, operational management, feasibility studies, project due diligence to grass roots exploration.

- Current director of Lexington Gold Ltd (AIM:LEX) and Ex chair of Osmond Resources Ltd (ASX:OSM).

Simon Buswell-Smith – Managing Director

- Geologist with over 15 years of mining and exploration experience, predominately in Western Australia.

- Experience in project evaluation, resource estimation, open pit mining across multiple commodities including gold, nickel and copper.

- Held key management positions in ASX-listed mining exploration companies, Kin Mining (ASX:KIN) and Great Southern Mining (ASX:GSN).

Sam Zheng – Non-Executive Director

- Dynamic asset manager with over 10 years’ experience and a portfolio exceeding A$200 million.

- Successfully managed funds in the mining sector, steering investments into companies like Black Cat Syndicate (ASX:BC8), Lithium Plus (ASX:LPM), Octava Minerals (ASX:OCT), Power Minerals (ASX.PNN) and Patagonia Lithium (ASX:PL3).

Acknowledgement

By clicking “Submit Bid” on the website form, you acknowledge and agree that:

- You have read and understood the terms and conditions to access the electronic version of the Prospectus;

- You are an Australian resident and you are requesting a copy of the Prospectus from within Australia;

OR

If you are a non-Australian resident, you have consulted your professional adviser as to whether any governmental or other consents are required or whether any other formalities need to be considered and followed before accessing the Prospectus.

Marketech clients can bid for the offer by clicking the link below and including account number and bid amount/shares.

In order to be eligible for this allocation, you need to have:

- a current subscription to the Marketech Focus platform;

- a Marketech trading account number and HIN;

- a Macquarie CMA linked to your trading account

- read and understood the Prospectus;

- Bids under the Offer must be for a minimum of $2,000 worth of Shares (10,000 Shares) and thereafter, in multiples of $500 worth of Shares (2,500 Shares).

Please note:

- The Company and Lead Manager reserve the right to close the book early and to deem any bid invalid;

- All bids which have not been withdrawn by the closing time of the offer will represent irrevocable commitments to subscribe for a number of Securities up to the maximum amount for which a bid is made and will be capable of acceptance in full or in part by the Lead Manager, at its discretion;

- Marketech will be paid a fee on amounts raised under this offer.

Related Articles

GREEN AND GOLD MINING LIMITED - INITIAL PUBLIC OFFER (IPO)

Green and Gold Minerals Limited (Proposed ASX code: GG1) Initial Public Offer (Offer) The Lead Manager, has invited Marketech Focus clients to participate in the Initial Public Offer (Offer) for Green and Gold Minerals Limited (Company or GG1). Green ...Mount Hope Mining Limited (MHM.ASX) INITIAL PUBLIC OFFER (IPO) - CLOSED

Mount Hope Mining Limited (Proposed ASX code: MHM) Initial Public Offer (Offer) Mount Hope Mining Limited (ACN 677 683 055) (Company) is pleased to present this opportunity to investors to invest in the Company. The Company is seeking to list on the ...NEXSEN LIMITED - INITIAL PUBLIC OFFER (IPO) - CLOSED

Nexsen Limited (Proposed ASX code: NXN) Initial Public Offer (Offer) Alpine Capital, the Lead Manager, has invited Marketech Focus clients to participate in the Initial Public Offer (Offer) for Nexsen Limited, a nano-biotechnology company developing ...Fulcrum Lithium Limited (FUL.ASX) INITIAL PUBLIC OFFER (IPO) - CLOSED

Fulcrum Lithium Limited (Proposed ASX code:FUL) Initial Public Offer (Offer) Update 22/10/24 The supplementary prospectus for the Fulcrum IPO was lodged on Friday (18/10), with it being tightened up in favour of the incoming investors. The below key ...Stormeur Limited (STR.ASX) INITIAL PUBLIC OFFER (IPO) - CLOSED

Stormeur Limited (Proposed ASX code:STR) Initial Public Offer (Offer) Liquidity Technology Pty Ltd (Liquidity), the Lead Manager, has invited Marketech Focus clients to participate in the Initial Public Offer (Offer) for leading Australian company ...